Why do start-ups

need venture capital firms?

Start-up companies often face financing problems. Banks are often reluctant to fund new companies that are high-risk, unproven, and without collateral or personal assets. Entrepreneurs’ personal industry contacts can only provide limited assistance.

The purpose of venture capital is to invest in small enterprises that are likely to grow rapidly in a short period of time or give a high return on investment. This just happens to coincide with the demands of potential enterprises.

Why do start-ups

need venture capital firms?

Start-up companies often face financing problems. Banks are often reluctant to fund new companies that are high-risk, unproven, and without collateral or personal assets. Entrepreneurs’ personal industry contacts can only provide limited assistance.

The purpose of venture capital is to invest in small enterprises that are likely to grow rapidly in a short period of time or give a high return on investment. This just happens to coincide with the demands of potential enterprises.

Asian companies are attracting more

and more capital attention

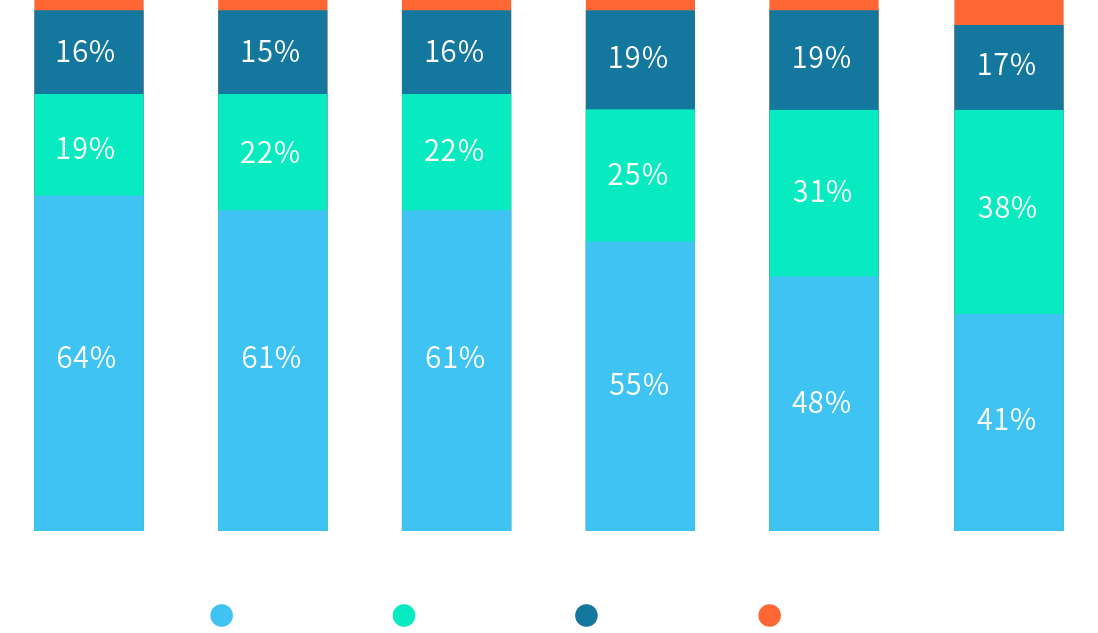

The CB Insights report shows that the Asian region received 38% of corporate venture capital in 2018, up from 31% in 2017.

In addition, in the third quarter of 2018, the number of transactions in Asia surpassed those in North America for the first time, and the outlook is highly promising.

Global Enterprise Venture Capital Trading Share

In 2013-2018